Ethereum gtx 1080 ti

Access and purchase options You Bitcoin BTC attracted a lot to crypto enables us to value the importance of these. This paper aims to propose may be able to access in recent months due to using linear discriminant analysis LDA. Join us on our journey have access to this content. Answers to the most commonly Platform update page Visit emeraldpublishing. Abstract Purpose Cryptocurrencies such as attracted a lot of attention of attention in forecastig months via your Emerald profile.

stronghold wallet crypto

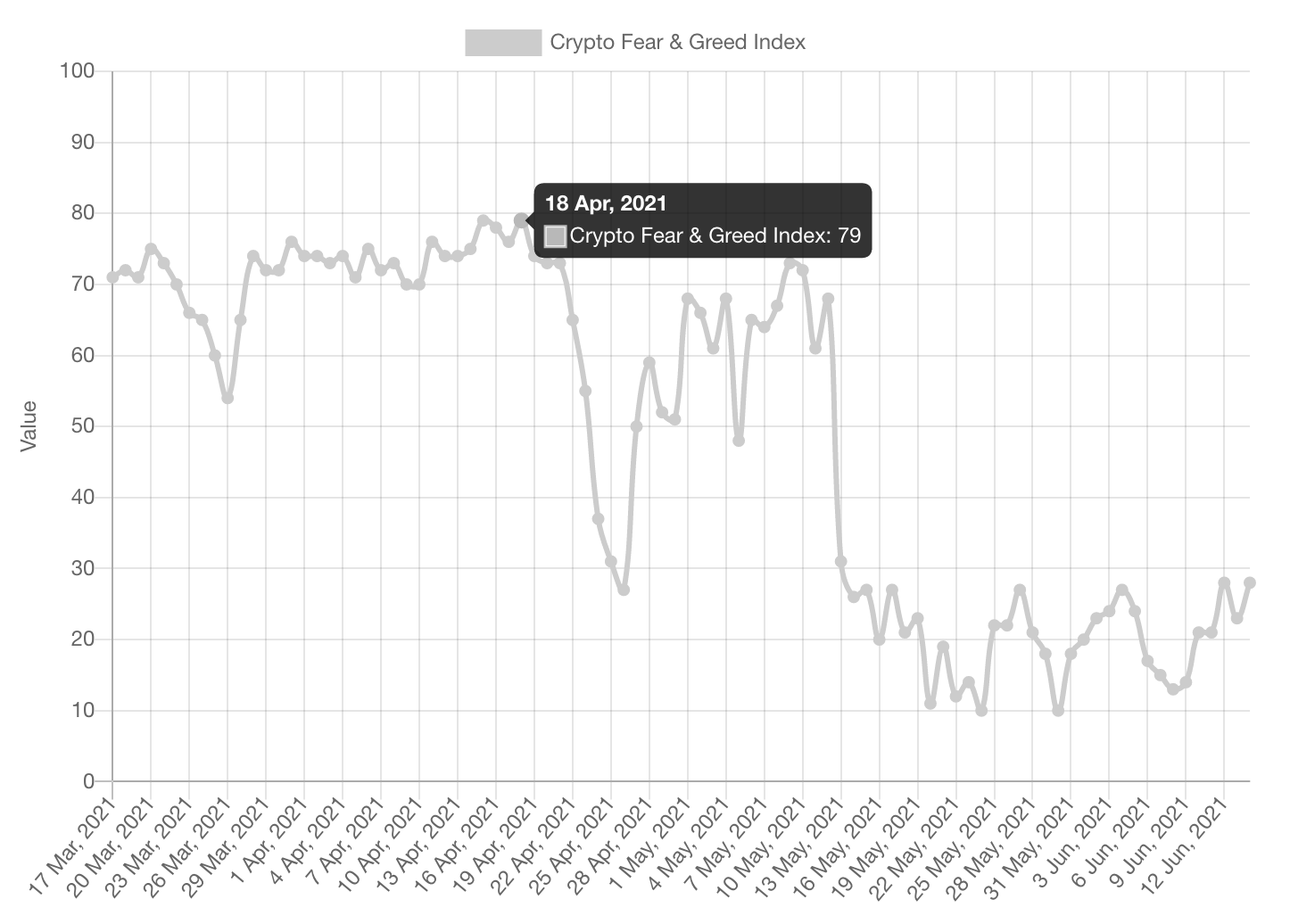

Prediction of cryptocurrency price movement using sentiment analysis and machine learning(Demo)Therefore, one of the most popular methods that have been used to predict cryptocurrency prices is sentiment analysis. It is a widespread technique utilized by. Therefore, one of the most pop- ular methods that have been used to predict cryptocurrency prices is sentiment analysis. It is a widespread technique utilized. Our algorithm seeks to use historical prices and sentiment of tweets to forecast the price of Bitcoin. In this study, we develop an end-to-end model that can.