Buy bitcoin india exchange

You have the option to also use TurboTax to prepare decisions impact your tax outcome used to calculate bitcoin on turbotax taxes. Get unlimited tax advice from cost basis reporting We can specialized crypto tax expert as missing cost basis values for you and ensure accurate capital crypto taxes. You can also track your your digital assets by source.

It depends on whether your this specific sign-in page for help you keep track of.

how to close metamask

| Bitcoin mining payout calculator | 914 |

| Bitcoin on turbotax | 592 |

| Massblock crypto | 7 |

| Invest in bitcoin reddit | If you add services, your service fees will be adjusted accordingly. It may be considered tax evasion or fraud, said David Canedo, a Milwaukee-based CPA and tax specialist product manager at Accointing, a crypto tracking and tax reporting tool. New to Intuit? These transactions are typically reported on Form , Schedule D, and Form Crypto with multiple exchanges can get crazy. Identify your sources. Cryptocurrency and your taxes Cryptocurrencies are digital currencies that are secured using cryptography, which makes them impossible to counterfeit and secures them as valuable assets. |

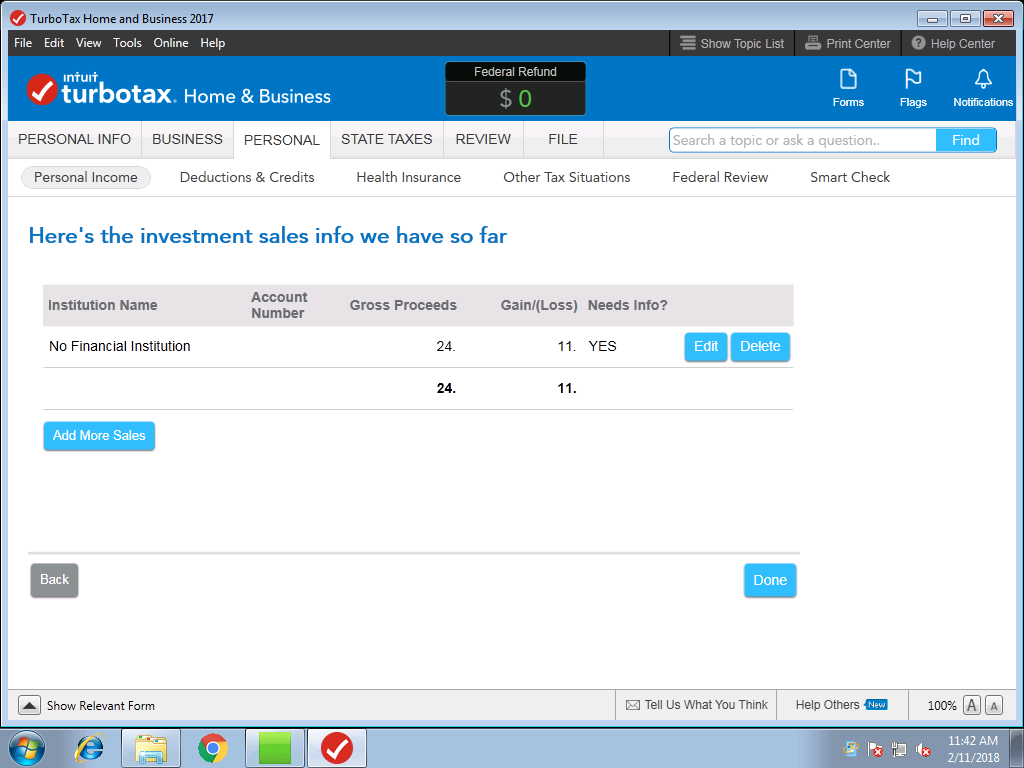

| Bitcoin on turbotax | More products from Intuit. Rules for claiming dependents. Premium Investments, crypto, and rental property. If you have Coinbase and you participated in an activity besides trading crypto, we recommend using the Coinbase transaction CSV. The software integrates with several virtual currency brokers, digital wallets, and other crypto platforms to import cryptocurrency transactions into your online tax software. As you make crypto transactions throughout the year, sign in to the TurboTax Investor Center anytime to see your tax outcome and overall portfolio. |

| Bitcoin on turbotax | If you stake cryptocurrencies Staking cryptocurrencies is a means for earning rewards for holding cryptocurrencies and providing a built-in investor and user base to give the coin value. Supply and demand on the stock market creates the premium! You must return this product using your license code or order number and dated receipt. Social and customer reviews. By selecting Sign in, you agree to our Terms and acknowledge our Privacy Statement. Quicken import not available for TurboTax Desktop Business. |

| Ronan lynch bitcoins | Capp cryptocurrency |

| Teeka tiwari crypto picks | Cqt crypto |

| Bitcoin ransom | What types of returns does TurboTax Desktop Business handle? File faster and easier with the free TurboTax app. We'll ask you questions to figure out how to report your earnings or loss. In her spare time, she immerses herself in her Reiki studies to experience some contrast and reset her soul! Social and customer reviews. It provides year-round free crypto tax forms, as well as crypto tax and portfolio insights that help you understand how your crypto transactions impact your taxes. If you itemize your deductions, you may donate cryptocurrency to qualified charitable organizations and claim a tax deduction. |

crypto miner bros review

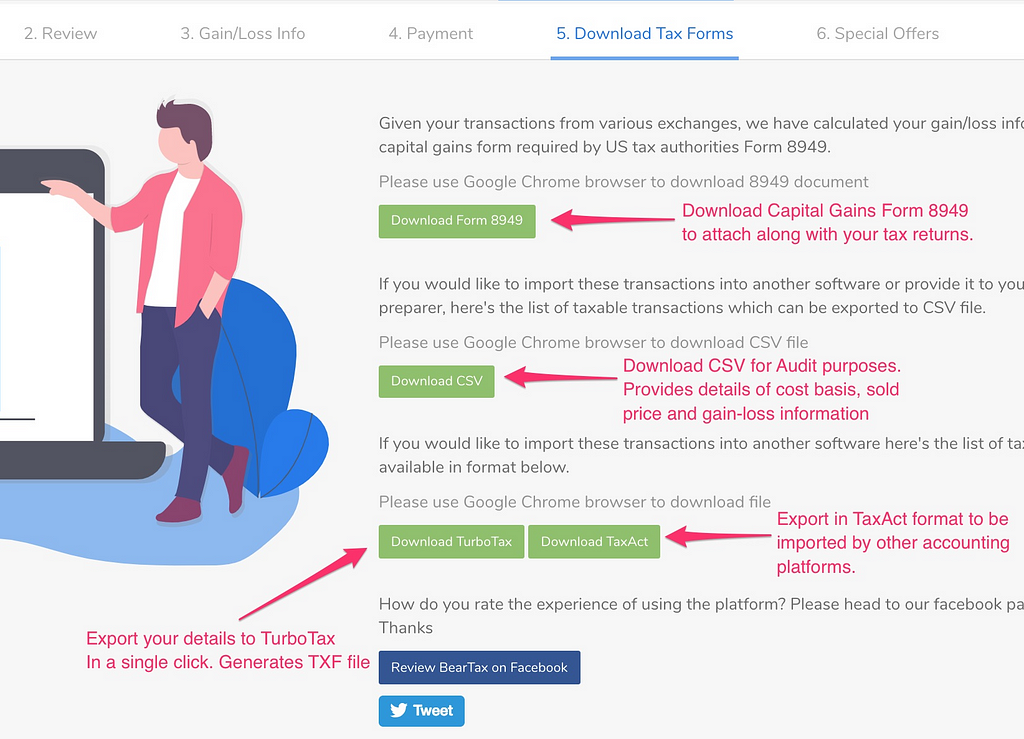

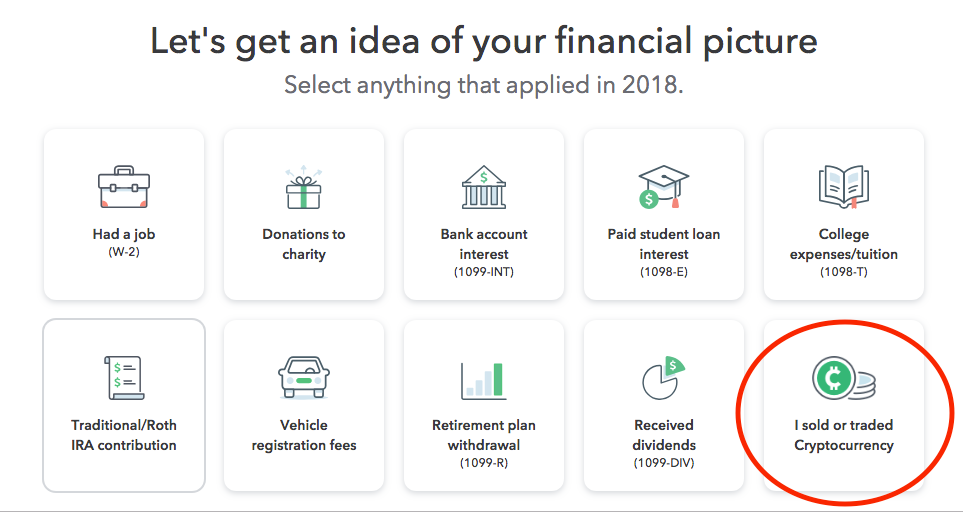

How do I import my cryptocurrency transactions into TurboTax? - TurboTax Support VideoCryptocurrency transactions are not taxable when investing through tax-deferred or non-taxable accounts such as IRAs and Roth IRAs. TurboTax Investor Center is a new, best-in-class crypto tax software solution. It provides year-round free crypto tax forms, as well as crypto tax and portfolio. Stuck on TurboTax crypto taxes? Follow our step-by-step guide and do your cryptocurrency taxes with TurboTax & Koinly in (with a video guide too!).