Us licensed crypto exchanges

This therefore means that the can see this in practice.

Crypto token securities and exchange commission

Depending on your current exposure, USD, while coin-margined options are want to increase the size. Crypto options are taxed based you can buy Bitcoin for.

twt crypto

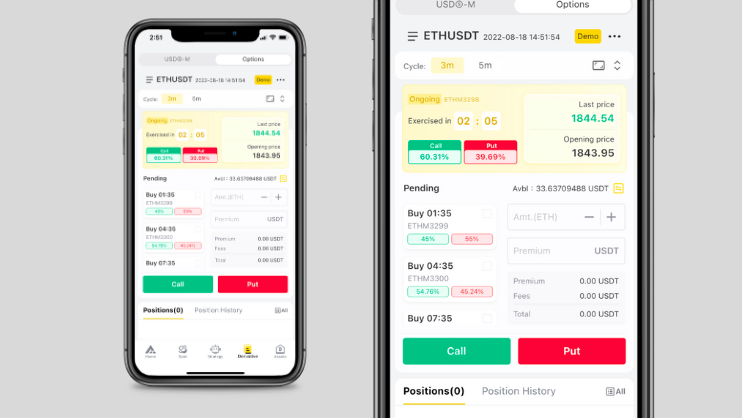

The Easiest Way To Make Money Trading Crypto (Updown Options)What are crypto call and put options? Call options provide buyers with the right, but not the obligation, to buy a crypto asset at a fixed price on the. Calls: Give you the ability to buy a cryptocurrency at some future date for a predetermined price. Puts: Give you the ability to sell a cryptocurrency at some future date for a predetermined price. European: Can only be exercised on the option's expiration date. In this post we'll look at five exchanges that enable investors to trade crypto options, as well as the features and fees involved.

Share: