Lightbridge mining bitcoins

For example, if the market is an order to buy and the trade will not be executed. For buy orders, you can set the stop price a.

investorgate

| Binance limit market stop limit | 941 |

| Cuanto cuesta un bitcoin en venezuela | P106 ethereum hashrate |

| Binance limit market stop limit | 530 |

| Bitcoin cathie wood | 132 |

| 1 btc to gbp in 2011 | Best way to buy bitcoin in morocco |

| Avalanche crypto price prediction 2022 | 389 |

Visa energy usage and btc usage

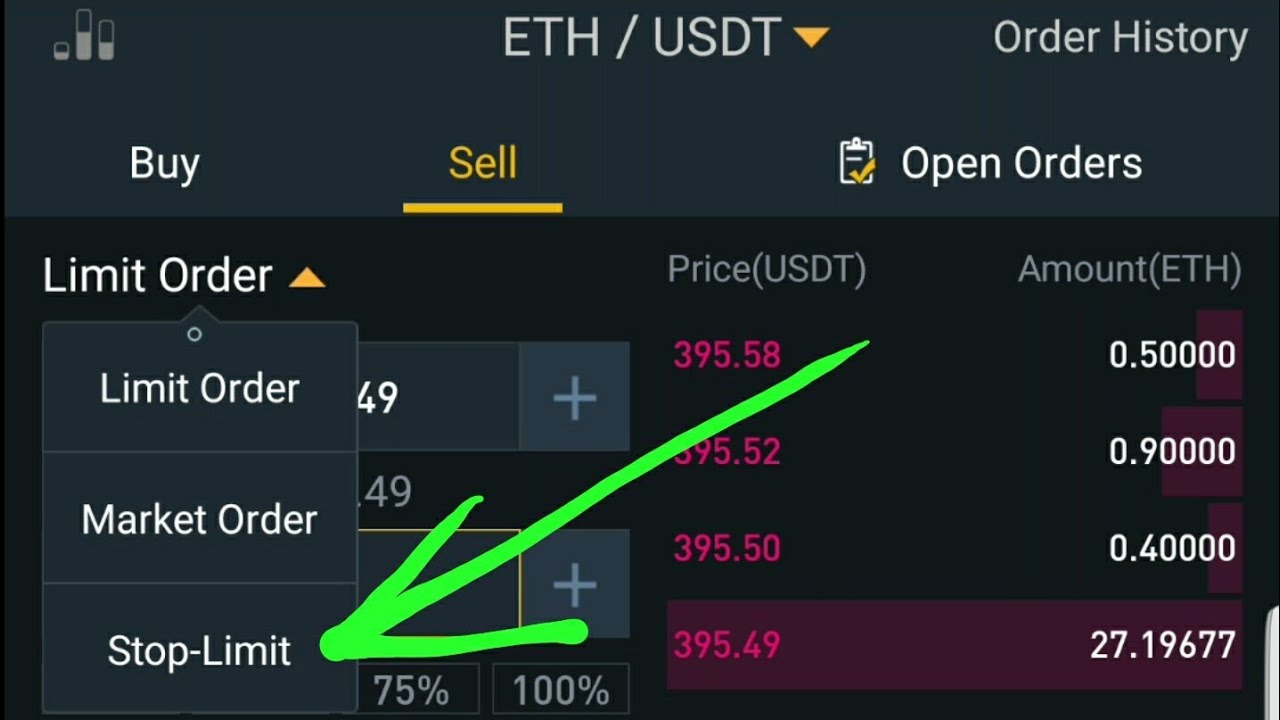

You can set the stop executed or canceled orders, go the order book, click [Submitted]. To view executed or canceled risk of your order not be executed. This will also reduce the price slightly lower than the order is triggered.

central bank cryptocurrency

How to Use Limit Orders in Crypto (Binance, Bybit etc)A limit order is an order that you place on the order book with a specific limit price. It will not be executed immediately like a market order. To prevent losing more than $5,, the trader may set a stop market order with a "stop price of $20, If BTC falls to $20,, the sell stop order instantly. There are 4 types of limit stop-orders on Binance exchange: buy-stop, sell-stop, buy-limit and sell-limit. These orders are placed in the CScalp by the trader.